July 15, 2019

4 Key Financial Metrics That Should Be Measured For All Startups

“29% of startups fail because they eventually run out of cash.”

Most entrepreneurs are well skilled and informed about the best way to build their product, as well as find and retain valuable customers in the initial phase. However, what young entrepreneurs tend to overlook at the starting, is how to take their startup to the next level. This is mostly due to the lack of a well-thought-of business model.

Tracking important business metrics by making the best use of data is imperative for measuring results and opening new doors of possibilities for your startup. Take a look at the 4 key financial metrics that should be tracked periodically for every startup owner -

Source: Patriot Software

Understanding these two costs is crucial as it will help you have an idea about the time required for your startup to break even and the length of your startup runway - the duration for which your business can survive if both your expense and revenue remain constant.

Source: Patriot Software

Understanding these two costs is crucial as it will help you have an idea about the time required for your startup to break even and the length of your startup runway - the duration for which your business can survive if both your expense and revenue remain constant.

Source: Expert Program Management

After this analysis has been made, it will be easier to gain insight into the amount of money you further need to raise and the time required for making investments.

Source: Expert Program Management

After this analysis has been made, it will be easier to gain insight into the amount of money you further need to raise and the time required for making investments.

Source: Wordstream

Having a fair understanding of these two metrics is integral for every startup to prevent premature scaling.

Source: Wordstream

Having a fair understanding of these two metrics is integral for every startup to prevent premature scaling.

Source: ProBooks NY

Economic growth is very important for a startup to be successful, as businesses that cannot scale will not be able to stay in the business. In order to have a sound business model, having a close track of your finances is one of the first steps, all the more in the first phase of launching your startup. To know more, leave us a message and we’ll get back to you.

Source: ProBooks NY

Economic growth is very important for a startup to be successful, as businesses that cannot scale will not be able to stay in the business. In order to have a sound business model, having a close track of your finances is one of the first steps, all the more in the first phase of launching your startup. To know more, leave us a message and we’ll get back to you.

1. Fixed and Variable Costs

The total cost incurred for running your startup is one of the most important metrics that needs to be measured. The regular spendings of running a business can be divided into two types - fixed and varied. Fixed costs are the ones that remain steady for the products you make or the services you offer. Expenses like office rent, Internet bills, insurance, salary credits are examples of fixed costs. Variable costs, on the other hand, changes depending on your production value like material or labour costs. Source: Patriot Software

Understanding these two costs is crucial as it will help you have an idea about the time required for your startup to break even and the length of your startup runway - the duration for which your business can survive if both your expense and revenue remain constant.

Source: Patriot Software

Understanding these two costs is crucial as it will help you have an idea about the time required for your startup to break even and the length of your startup runway - the duration for which your business can survive if both your expense and revenue remain constant.

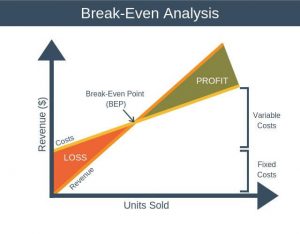

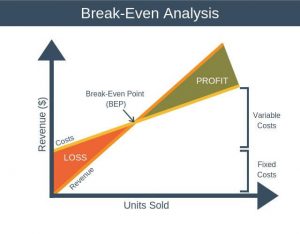

2. Break-Even Analysis

The Break-Even point of a company is a time when the revenues match the expenses. Beyond the breakeven point, all financial gains are termed as profits. Break-even analysis can help determine when your startup will be able to cover all costs and start making profits. Apart from that, it can also help you plan out other things such as -- The profitability of your existing product line or service

- Number of units that needs to be sold before you start making a profit

- If reducing the volume of your sales or the price of your product/service will have an impact on your profit

- If there is a need for an increase in price or volume of sales to make up in case there is an increase in the fixed costs

Source: Expert Program Management

After this analysis has been made, it will be easier to gain insight into the amount of money you further need to raise and the time required for making investments.

Source: Expert Program Management

After this analysis has been made, it will be easier to gain insight into the amount of money you further need to raise and the time required for making investments.

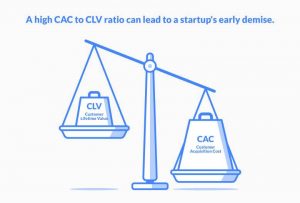

3. Customer Acquisition Cost & Lifetime Value of Customer

In order to achieve growth and scalability, it is important for every startup to have a scalable business model, as your sales and marketing efficiency depends on it. For this purpose, it is important to measure two metrics - Customer Acquisition Cost (CAC) and Lifetime Value of Customer (LVC). CAC refers to the total cost incurred of converting a potential lead into a customer. It is calculated by dividing the total costs incurred for attracting customers divided by the number of customers that were acquired in the time period. For example, if Rs. 5000 was spent on your promotions for a month and 20 customers were acquired during this month, the CAC rate is Rs. 250. LVC refers to the projected revenue a customer is likely to generate in his/her lifetime. This metric is useful in understanding a rational cost per acquisition. It is calculated by multiplying the cost of your service annually with the number of years a customer is expected to use your services. For instance, if the annual service cost is Rs. 1000 and on an average, a customer stays for 5 years, the LVC would be Rs. 5000. In the initial months, calculating the LVC can be difficult due to the lack of cohesive data. Source: Wordstream

Having a fair understanding of these two metrics is integral for every startup to prevent premature scaling.

Source: Wordstream

Having a fair understanding of these two metrics is integral for every startup to prevent premature scaling.

4. Forecasting Cash flow

Cash flow is a comparative measurement of the amount of money that is coming into your business against the amount that is being spent. This metric actually determines the ‘financial health’ of your brand. When funds exceed the expenditure, it is termed as positive cash flow and when the expenditure exceeds the funds, it is termed as negative cash flow. Forecasting the cash flow of your startup will help you have a clear idea of when your money is coming in and when is it going out, and what you’re left with at the end of every month after all expenses have been made. Forecasting cash flow will ensure that you do not spend more than required in order to stay in the business. Source: ProBooks NY

Economic growth is very important for a startup to be successful, as businesses that cannot scale will not be able to stay in the business. In order to have a sound business model, having a close track of your finances is one of the first steps, all the more in the first phase of launching your startup. To know more, leave us a message and we’ll get back to you.

Source: ProBooks NY

Economic growth is very important for a startup to be successful, as businesses that cannot scale will not be able to stay in the business. In order to have a sound business model, having a close track of your finances is one of the first steps, all the more in the first phase of launching your startup. To know more, leave us a message and we’ll get back to you.